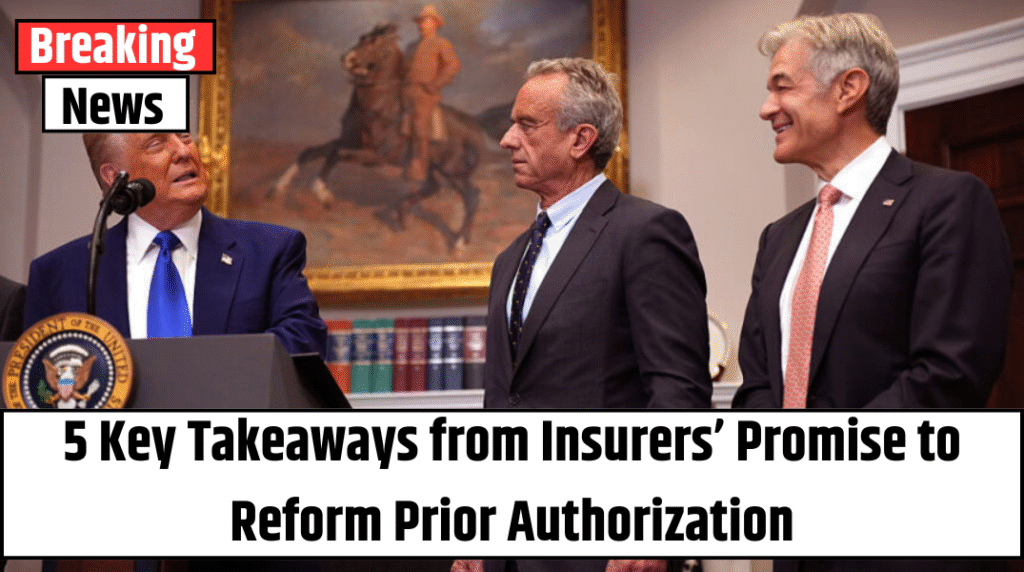

In a landmark move triggered by growing public pressure and a shocking high-profile tragedy, dozens of major U.S. health insurers—including Cigna, Aetna, Humana, and UnitedHealthcare—have agreed to overhaul their controversial prior authorization process. The announcement, made Monday, comes nearly seven months after the fatal shooting of a top insurance executive ignited national debate about barriers to timely medical care.

A Historic Industry Pledge—But Not a Mandate

The agreement, while non-binding, represents one of the most sweeping voluntary reforms in recent memory for an industry long criticized for bureaucratic obstacles that delay or deny doctor-recommended care. Insurers have committed to reducing the number of procedures that require prior authorization, expediting review times, using clear language in communications with patients, and ensuring that medical professionals—not automated systems—review denials.

“This is a step forward, not a finish line,” said Dr. Mehmet Oz, Administrator of the Centers for Medicare & Medicaid Services (CMS). “It’s an opportunity for the industry to earn back public trust. But if they don’t follow through, we will act.”

What Triggered the Industry Shift?

The public reckoning around prior authorization reached a boiling point last December when Brian Thompson, CEO of UnitedHealthcare, was fatally shot in New York City. While authorities have not officially linked the motive to healthcare disputes, the tragedy brought unprecedented attention to insurance practices and the burdens placed on patients and providers.

Government officials and policy analysts agree: the industry is under pressure to change—fast.

“Violence in the streets isn’t the answer,” said CMS senior official Chris Klomp, “but it has undeniably elevated this issue to the forefront. Insurers know their reputation is on the line.”

Also Read – Millions of Americans Face Medical Isolation with No Doctors or Telehealth

Promised Changes That Could Affect Millions

Among the key changes:

-

Fewer preapprovals: Insurers will reduce the number of medical procedures requiring prior authorization. CMS officials recommended eliminating it for common procedures like colonoscopies, knee arthroscopies, cataract surgeries, and vaginal deliveries.

-

Faster decisions: Insurers aim to issue 80% of preauthorization approvals in real time by 2027.

-

90-day grace period: Patients switching health plans will have 90 days to continue receiving care without needing new approvals from their new insurer.

-

Clearer communication: Insurance companies pledge to use straightforward, jargon-free language in denial letters and benefit explanations.

-

Public dashboards: Insurers have agreed to share prior authorization data online—though details remain sparse for now.

Critics Say It’s Still Not Enough

Despite the promises, some experts remain skeptical. “These are good intentions, but implementation is everything,” said Kaye Pestaina of KFF, a nonprofit health policy group. “Prior authorization is still a black box for many patients who don’t even know it’s required—until their care is denied.”

Others question whether insurers will follow through without stricter federal oversight. Dr. Bobby Mukkamala, President of the American Medical Association, welcomed the reforms but cautioned that “doctors and patients have heard similar pledges before—with little actual impact.”

Technology and AI: Help or Hindrance?

Insurers are increasingly turning to artificial intelligence (AI) to streamline decisions. While AI promises speed and consistency, concerns about fairness and accuracy persist. A recent AMA survey found that 61% of doctors worry AI is already causing more denials—often without adequate clinical review.

Rep. Gregory Murphy (R-NC), a practicing physician, said during the announcement, “AI has huge potential, but only if the data guiding it is sound. Garbage in, garbage out still applies.”

The Bigger Picture: Reform, Regulation, and Reality

The health insurance industry’s move may also be a calculated effort to avoid more aggressive federal or state regulations. “Insurers are reading the political room,” said Robert Hartwig, a healthcare economist. “This pledge is a strategic play to prevent what could become a regulatory crackdown.”

Also Read – U.S. Cuts Vaccine Group Funding Over Claims It ‘Ignored the Science’

Already, the Affordable Care Act requires insurers to communicate clearly, and upcoming federal rules finalized by the Biden administration will soon mandate electronic processing of prior authorizations and faster response times for Medicare and Medicaid plans.

Some states are even experimenting with “Gold Card” programs, allowing doctors with a history of successful prior authorization requests to skip the process altogether.

What’s Still Missing?

-

A full list of participating insurers won’t be public until later this summer.

-

“Low-value codes” that may no longer require prior authorization have yet to be identified or released.

-

CMS has yet to define performance benchmarks or enforcement strategies.

Final Thought: A Window Into Healthcare’s Future?

The renewed focus on prior authorization highlights a broader battle over who controls healthcare decisions—doctors or algorithms?

While Monday’s announcement offers hope, only time will tell whether these promises evolve into lasting reform—or if this moment will be remembered as another missed opportunity.